🔴 The Stock Market Faces a Rough Friday Amid Recession Worries 🔴

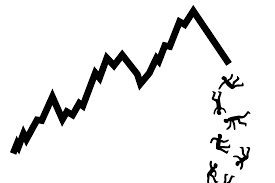

New York, NY (Aug 3, 2024) — The stock market took a significant hit on Friday, with the Dow Jones Industrial Average plunging 600 points and the Nasdaq Composite entering correction territory. The sharp declines were fueled by a much weaker-than-expected jobs report for July, heightening fears of a potential recession.

📉 The Numbers

- Dow Jones: Down 610.71 points (-1.51%), closing at 39,737.26.

- S&P 500: Dropped 1.84%, ending at 5,346.56.

- Nasdaq Composite: Lost 2.43%, closing at 16,776.16, marking a 10% decline from its recent all-time high.

📊 Key Highlights

1. Weak Jobs Report Triggers Panic

The U.S. Labor Department reported a slowdown in job growth, with nonfarm payrolls increasing by just 114,000 in July, a sharp decline from June’s 179,000 and below economists’ expectations of 185,000. The unemployment rate rose to 4.3%, the highest since October 2021.

2. Tech Giants Take a Hit

Big Tech suffered significant losses, with Amazon tumbling 8.8% after missing revenue estimates and providing a gloomy forecast. Intel plummeted 26% due to weak guidance and impending layoffs, while Nvidia slid 1.8%.

3. Bank Stocks Struggle

Amid rising recession fears, bank stocks were not spared. Bank of America fell 4.9%, and Wells Fargo dropped 6.4%.

📸 Digital Assets & Visuals

- Hero Image: A stark photo of traders on the NYSE floor, embodying the market’s tumultuous day.

- Charts: Visual representation of the Dow, S&P 500, and Nasdaq’s performance over the past week.

- Infographics: Breakdown of sectors affected, highlighting the performance of Tech and Financials.

💼 Expert Opinions

Adam Turnquist, Chief Technical Strategist at LPL Financial, noted, “The Nasdaq was overbought coming into July, driven by AI hype. This correction isn’t the end of the AI story, but a necessary reality check.”

Claudia Sahm, the founder of the Sahm Rule, mentioned, “While the Sahm Rule signals caution, we are not in a recession yet. The labor market is cooling, but the volume of concern might be too loud due to pandemic-related shifts.”

🛡️ Safe Havens in Turbulent Times

Amidst the market’s volatility, low-volatility stocks with strong dividends have emerged as potential safe havens. CNBC’s Pro Stock Screener highlights names across fast-food giants and premier defense contractors.

🌍 Global Market Impact

It’s not just the U.S. feeling the pressure. Japan’s Nikkei experienced its worst day since 2022, plummeting nearly 5%, signaling a precarious global market backdrop.

📈 Moving Forward

As investors brace for the Federal Reserve’s next move, the market’s reaction to Friday’s weak job figures suggests a growing belief that a rate cut might be necessary to stabilize the economy. The upcoming September Fed meeting will be crucial in shaping market expectations and future economic policy.

Stay tuned for further updates as we navigate these turbulent market conditions. 📊🚀

Stock market news, analysis, and updates—right here, right now.