The National Stock Exchange of India Ltd. (NSE) has seen its valuation skyrocket to $36 billion, doubling in just four months, as investors anticipate the exchange’s long-awaited initial public offering (IPO). Demand for NSE’s unlisted shares is soaring, with prices ranging between ₹5,700 to ₹6,500 ($68 to $78), according to insider sources.

What’s Driving the Surge? 🚀

- IPO Expectations: Investors are speculating that NSE may go public as early as the first quarter of 2025, creating high demand for its shares.

- Private Market Trading: Shares are being actively traded on private platforms, though the supply is limited, leading to inflated prices.

Wealth managers and high-net-worth individuals (HNIs) are particularly keen to own a slice of the exchange, driving the market frenzy.

A Rocky Path to IPO 🌩️

NSE first filed for an IPO in 2016, but plans were delayed after a regulatory ruling that barred it from the securities market for six months due to allegations of unfair market access. However, the Securities and Exchange Board of India (SEBI) cleared NSE earlier this month, paving the way for its listing.

NSE’s Big Backers 🏦

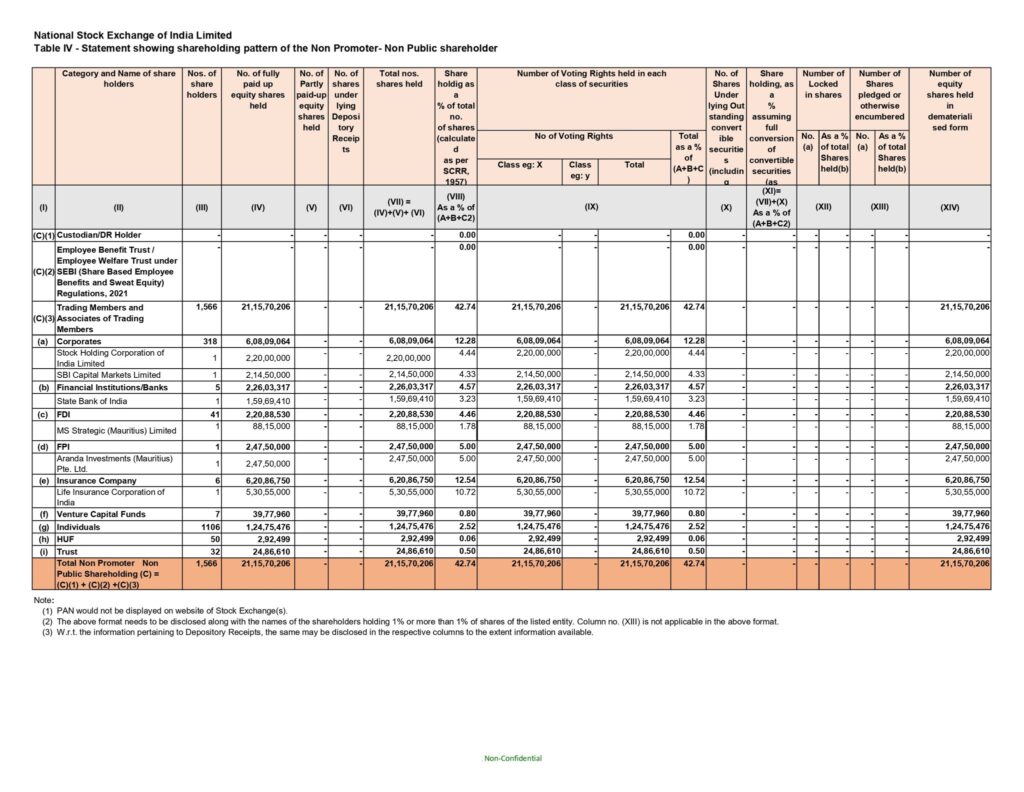

- Life Insurance Corporation of India (LIC) and Canada Pension Plan Investment Board are among the major stakeholders.

- Private equity firm ChrysCapital, which holds a 4% stake, valued the exchange between $17 billion and $18 billion in May 2024 before the current surge.

As NSE moves closer to finalizing its IPO plans, its valuation could climb even higher, signaling a landmark moment for the Indian financial markets.