Nvidia, the tech giant that has been the go-to company for AI hardware, just experienced a $279 billion drop in market value—leaving many scratching their heads. 🧐 Earlier this year, Nvidia was flying high, hitting a valuation of $3.3 trillion, largely fueled by the hype surrounding AI. But now, its stock has taken a massive 9.5% tumble in just a single day. 😳

🚩 What Happened?

Here’s what’s raising eyebrows:

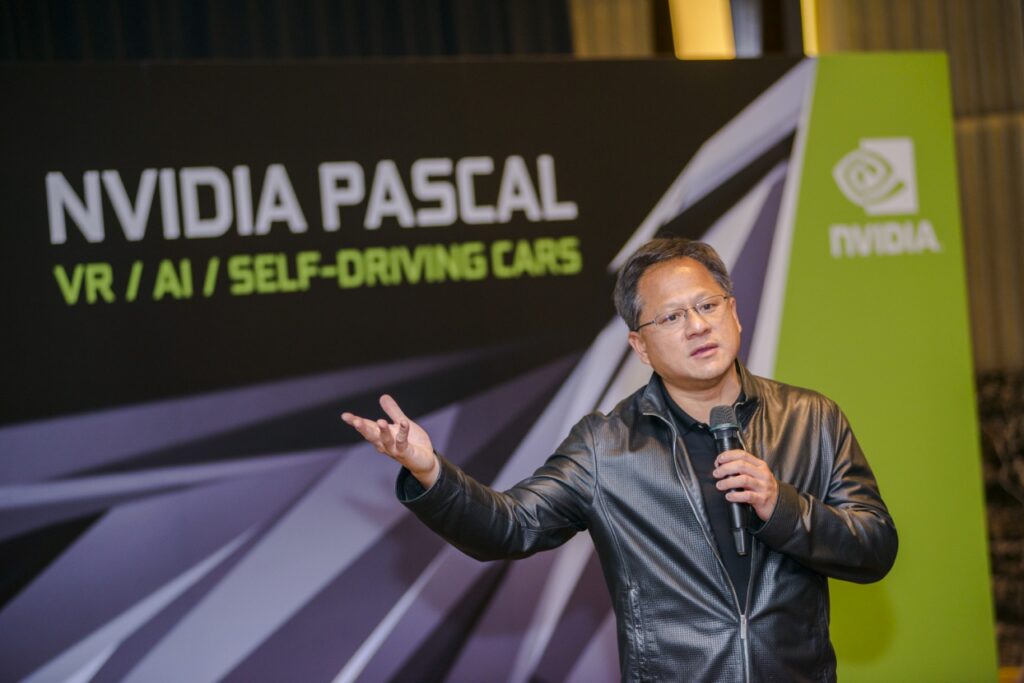

- CEO Jensen Huang reportedly lost $10 billion from his personal fortune in just 24 hours due to the dip in stock price. 😬

- Investors have become increasingly skeptical about the sky-high valuations of AI companies, causing them to hit the brakes on Nvidia’s runaway stock.

- Nvidia is supposed to be “selling the shovels in the AI goldrush,” with its cutting-edge AI chips, like the Nvidia H100, being snapped up by major players like Elon Musk’s xAI. But the markets seem unconvinced that the company’s revenue growth is enough to justify its valuation. 💰

🏗️ The Bigger Picture: Unproven Tech and Investor Skepticism

Nvidia has benefited massively from the AI revolution, with companies rushing to build data centers capable of running AI models. But this massive investment has yet to yield the returns that investors were hoping for, leading to fears that AI’s long-term profitability may not match the hype. 🤔

- Overblown Expectations?: Wall Street has been patient—until now. Analysts are questioning if all the billions being poured into AI tech will truly pay off, or if the world’s fascination with AI is a bubble waiting to burst. 💥

- Knock-on Effects: Nvidia’s stock slump has triggered a ripple effect, with shares in other AI-related companies also experiencing a downturn. 📉

🔍 Other Factors at Play

- Subpoena Rumors: Nvidia’s troubles may also be linked to rumors of a Department of Justice antitrust probe. Though the company has denied this, whispers of a subpoena have likely contributed to investor jitters.

- Nvidia’s Meteoric Rise: While the recent stock dip has shaken confidence, it’s worth noting that Nvidia’s stock is still up 120% year-to-date, and Huang maintains that their infrastructure investments are already delivering returns. 🚀

⏳ What’s Next for Nvidia?

Whether Nvidia can regain its momentum largely depends on how patient investors are willing to be as AI continues to develop. CEO Jensen Huang remains bullish, but it’s clear the hype train is slowing down, and investors are beginning to demand results, not just promises.

Stay tuned as we watch how Nvidia navigates this AI-fueled roller coaster. 🎢