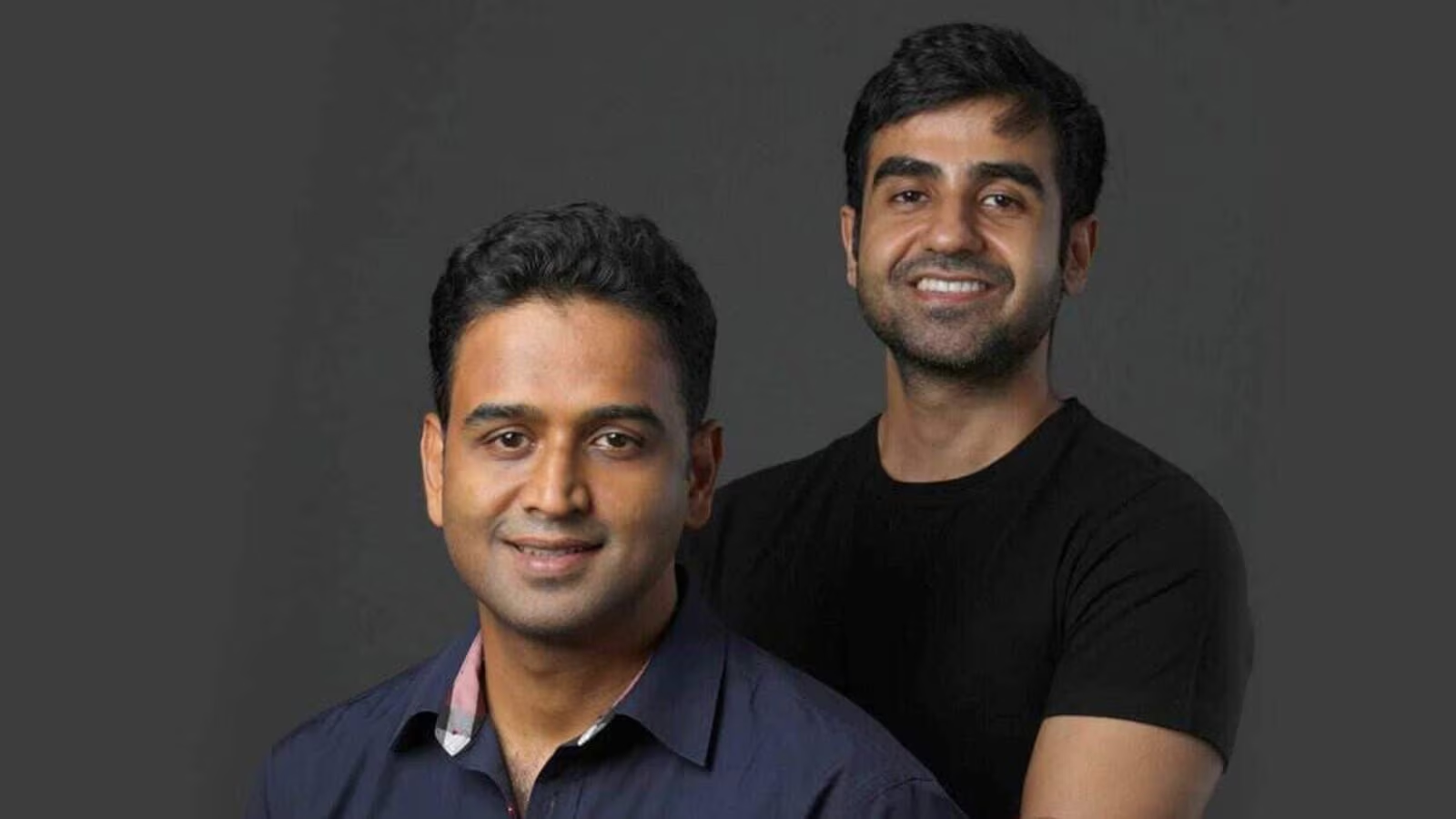

India’s biggest discount brokerage, Zerodha, isn’t in a rush to go public. In a recent chat, CEO Nithin Kamath spilled the tea: it’s all about diversification first, IPOs later—if at all. 👀

Kamath made it clear that Zerodha’s keeping its cool amidst the IPO hype from big names like Hyundai and Swiggy. “We want to build more businesses, get a solid grip, and only then think about an IPO—when it really makes sense,” he said. Translation: they’re sticking to their own game plan. 🕶️

IPO? Maybe, Maybe Not 🤷♂️

While they’re not shutting the IPO door, the vibe is leaning more towards nope. Nikhil Kamath, Co-founder and CFO, thinks you don’t need to go public to build trust. “Going public limits how much we can share,” Nikhil explained. “Maybe there are cooler ways to build transparency that are more real and honest.” 💬

The CTO’s Take: Freedom to Innovate ⚙️

Dr. Kailash Nadh, Zerodha’s Chief Tech Whiz, is totally vibing with this. For him, staying private means more freedom to innovate without the pressure of having to raise capital. “We don’t need the extra funds, so we get to make decisions that work for us,” Nadh said. 💡

SEBI Rules Shaking Things Up ⚖️

But here’s the catch: new SEBI rules are changing the game. These regulations mean brokers can only earn from brokerage fees, so Zerodha might have to bump up their charges. Nithin admitted it’s going to be a challenge. “The industry’s used to making money in all sorts of ways. We might need to up our brokerage fees,” he shared.

For now, Zerodha’s focusing on the long haul—diversifying, navigating new rules, and keeping things fresh, with or without an IPO. 🎯